A Biased View of Investment Representative

Wiki Article

How Investment Representative can Save You Time, Stress, and Money.

Table of ContentsTax Planning copyright for DummiesMore About Ia Wealth ManagementHow Investment Consultant can Save You Time, Stress, and Money.Indicators on Investment Consultant You Should KnowOur Lighthouse Wealth Management PDFsLighthouse Wealth Management Things To Know Before You Get This

“If you were to purchase something, say a television or a computer, you'll wish to know the specs of itwhat tend to be their elements and what it can do,” Purda details. “You can think about getting monetary guidance and help in the same way. People have to know what they are getting.” With monetary guidance, it is important to remember that this product is not bonds, shares or any other opportunities.It’s things such as budgeting, planning your retirement or paying down personal debt. And like getting a pc from a trusted organization, customers would like to know they're buying economic advice from a reliable pro. One of Purda and Ashworth’s most fascinating conclusions is about the charges that financial coordinators charge their clients.

This presented correct it doesn't matter the fee structurehourly, payment, assets under administration or predetermined fee (during the research, the buck value of costs was actually similar in each situation). “It still comes down to the worthiness proposal and anxiety regarding the people’ component which they don’t understand what these include getting into trade of these charges,” says Purda.

3 Simple Techniques For Financial Advisor Victoria Bc

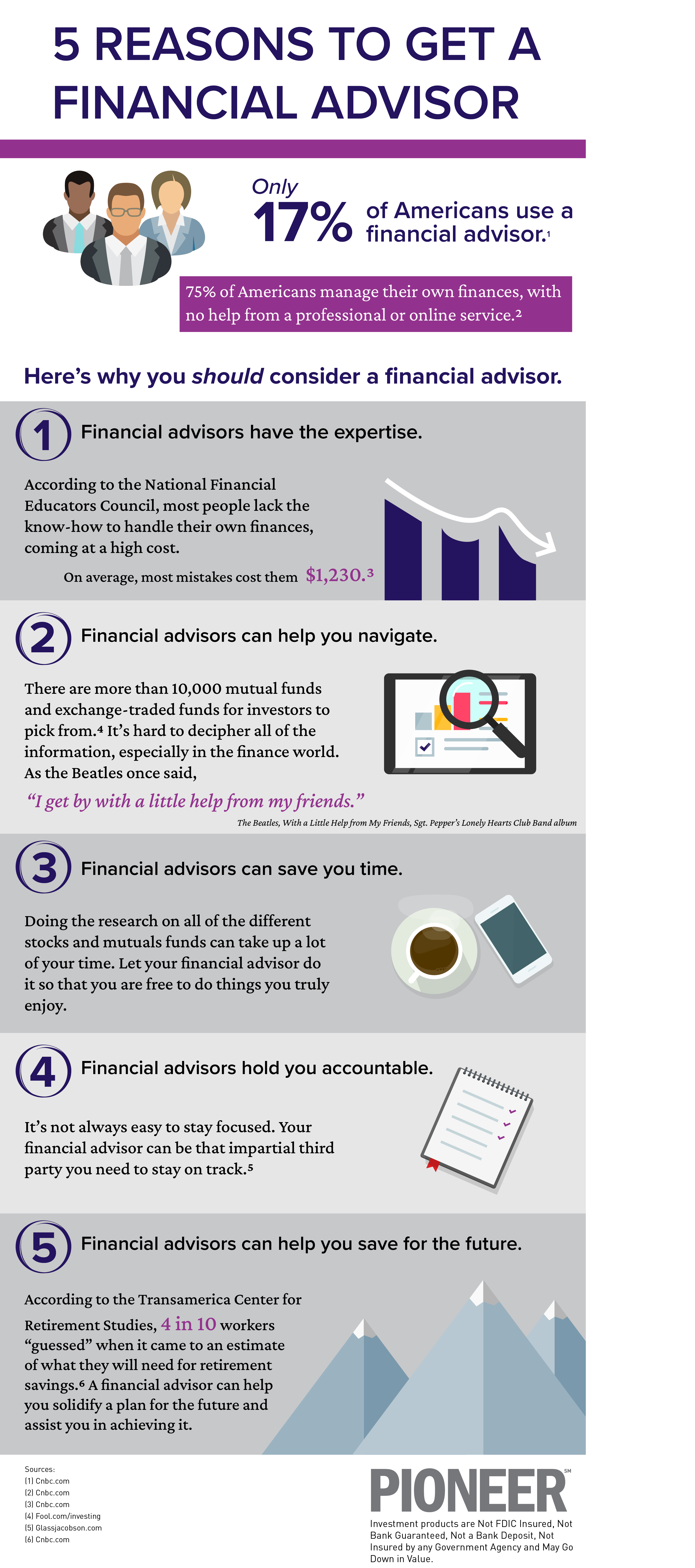

Hear this informative article once you listen to the term financial consultant, exactly what pops into the mind? Many consider a specialist who is able to provide them with economic advice, especially when you are looking at trading. That’s a great place to start, but it doesn’t paint the total picture. Not even near! Monetary advisors can really help individuals with a bunch of other money goals too.

A financial specialist assists you to develop wealth and shield it for the long haul. They could approximate your own future financial requirements and plan methods to stretch the pension cost savings. Capable additionally give you advice on when to begin experiencing personal protection and utilizing the cash within pension reports to help you avoid any terrible penalties.

The Only Guide to Private Wealth Management copyright

They may be able help you ascertain exactly what mutual resources are best for your needs and demonstrate how to handle and make more of your assets. They are able to in addition guide you to understand the threats and exactly what you’ll need to do to realize your aims. An experienced financial investment professional will help you stick to the roller coaster of investingeven if your investments get a dive.

They can supply you with the advice you'll want to develop an idea so you're able to make sure that your desires are performed. And also you can’t put a cost label in the reassurance that include that. Based on a recent study, the common 65-year-old few in 2022 needs to have around $315,000 saved to cover healthcare costs in your retirement.

Getting My Private Wealth Management copyright To Work

Given that we’ve reviewed exactly what monetary analysts carry out, let’s dig in to the different types. Here’s a great rule of thumb: All financial coordinators tend to be economic experts, yet not all experts are coordinators - https://www.pinterest.ca/pin/1151162354742517956. A financial planner focuses more information primarily on assisting people make intends to achieve lasting goalsthings like starting a college account or conserving for a down cost on a property

Exactly how do you understand which financial expert is right for you - https://www.brownbook.net/business/52411949/lighthouse-wealth-management-a-division-of-ia-private-wealth/? Here are a few activities to do to ensure you’re employing suitable person. What do you do once you have two bad options to select from? Effortless! Discover more solutions. The greater number of solutions you have got, the much more likely you might be to help make a decision

The Of Investment Representative

All of our wise, Vestor system makes it simple for you by revealing you around five monetary analysts who is able to last. The good thing is, it is free attain associated with an advisor! And don’t forget about to get to the meeting ready with a list of questions to inquire of in order to determine if they’re a great fit.But tune in, even though a specialist is actually smarter than the normal keep doesn’t give them the authority to let you know what to do. Often, analysts are full of on their own because they do have more degrees than a thermometer. If an advisor starts talking down for you, it's time for you demonstrate to them the doorway.

Keep in mind that! It’s important that you plus monetary specialist (whoever it ends up getting) take equivalent web page. Need a specialist who may have a long-lasting investing strategysomeone who’ll promote one keep spending regularly if the marketplace is up or down. investment representative. In addition don’t would you like to deal with someone that forces one to invest in something’s also dangerous or you’re uncomfortable with

The Main Principles Of Retirement Planning copyright

That combine offers the diversification you need to effectively spend when it comes down to long haul. When you study financial analysts, you’ll probably run into the word fiduciary duty. This all implies is any specialist you hire has got to act in a way that benefits their unique client rather than their self-interest.Report this wiki page